avalara tax codes by state

Total rate range 6-8. Add up to 20 tax codes.

Enablement Steps For Advanced Taxation Nimble Ams Help

We help companies to transact comply and grow with confidence.

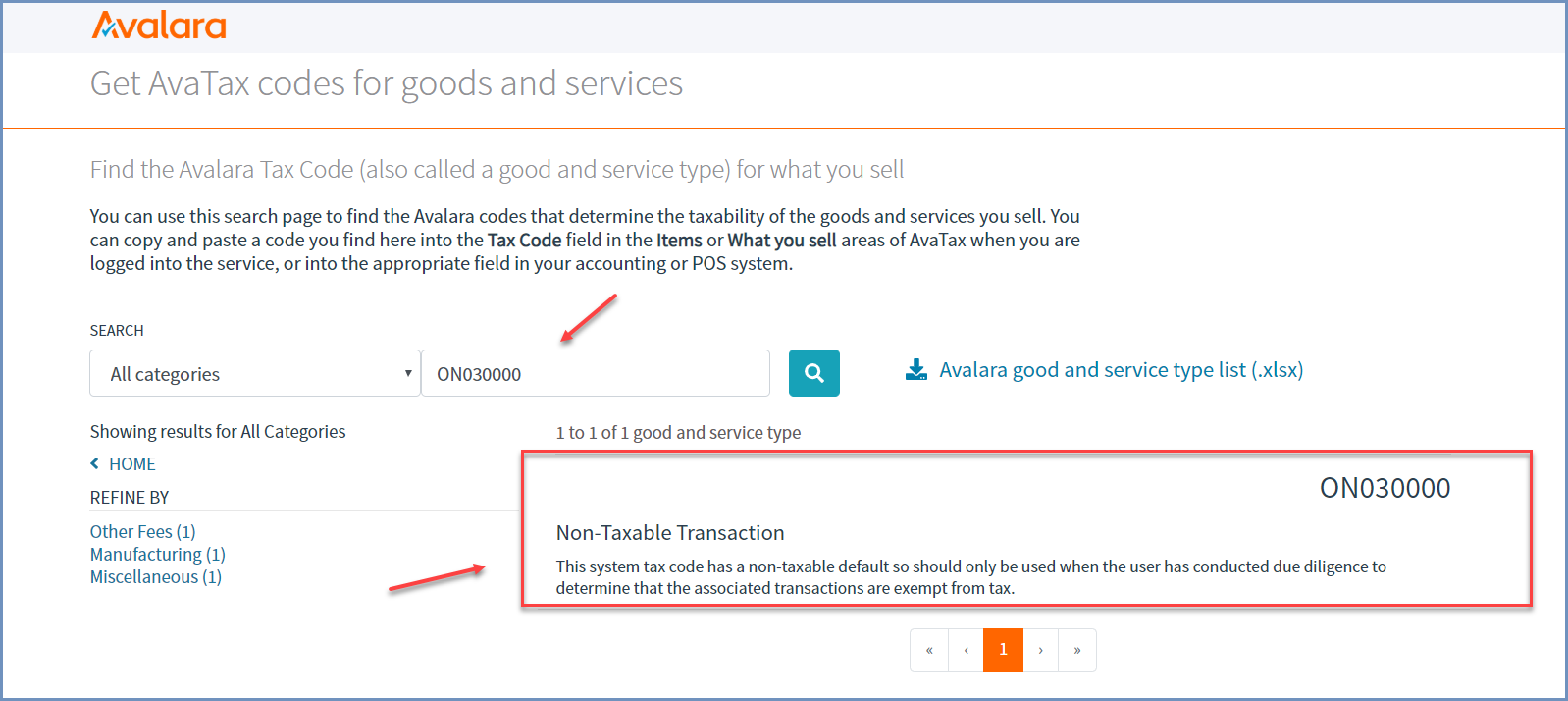

. Find the Avalara Tax Codes also called a goods and services type for what you sell. Ad Calculate Current Rates at the Point of Purchase. Ad Calculate Current Rates at the Point of Purchase.

The new tax codes are not yet certified by SST states and as such. Total rate range 4-9. Consumer use tax Buyer-owed taxes.

Ad Innovative Sales Use Tax Solution. Alabama state sales tax rate range. Integrates with Most Major ERP Systems.

Integrates with Most Major ERP Systems. The boundaries can change and often dont line up with tax rate jurisdictions. Automate Your Sales Tax Process Today.

Local rate range 0-2. The tax codes activated provide more granular support for many types of products and services including. 149 rows AvaTax for Communications supports tax calculation for a number of countries states territories and provinces.

Sales and use tax Retail ecommerce manufacturing software. You can use this search page to find the Avalara codes that determine the taxability of the goods and. The Default Product Tax Code you entered under Setup Taxes will be automatically populated.

Some products require special tax treatment. Industrial production or manufacturers. Due to varying local sales tax rates we.

Base state sales tax rate 6. This makes them the wrong tool to use for determining sales tax rates in the United States. Download State Sales Tax Rate Tables - Avalara.

Streamlined Sales Tax SST is a state-run program designed to make sales tax compliance easier and more affordable by offsetting the cost of using a tax technology provider like. Local rate range 0-5. Automate Your Sales Tax Process Today.

If you sell items such as clothing food software medical supplies software subscriptions and freight map them to. Tax codes PM020704 and PM020700. Avalara is pleased to offer simplified state-specific sales tax rate details for your business and filing needs.

Get a quick rate range. P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code. Due to varying local sales tax rates we strongly recommend using our calculator below for the most.

This change was effective in Avalara products on April 1 2018. Georgia state sales tax rate range. Base state sales tax rate 4.

77 rows Sales tax. Simply click on your state below and get the. By basing sales tax.

Every tax jurisdiction in AvaTax is assigned a unique jurisdiction ID code and name. However if your product falls in a different category you can enter. You can either start typing and select from the list of available tax codes or paste the appropriate tax code.

Avalara AvaTax is an advanced solution that uses geolocation and address verification to calculate sales tax down to a specific address accounting for multiple tax jurisdictions in a. To ensure accurate tax calculation Avalara recommends that. You can copy and paste from an Excel file or separate each.

Ad Innovative Sales Use Tax Solution. Local rate range 0-7. When to map items.

AvaTax uses these values to identify tax jurisdictions and apply the correct tax. Total rate range 4-11. We help companies to transact comply and grow with confidence.

State sales tax rates at your fingertips. Theyre useful in states like. Base state sales tax rate 4.

These tax codes are taxed at the full rate. Due to varying local sales tax rates we strongly recommend using.

Many States Routinely Apply Sales Taxes To Services Yet The Shift In Consumer Spending Leaves Us A Body Of Sales Tax Laws Originall Tax Guide Tax Software Tax

Free Book Sales Use Tax Compliance For Dummies Dummies Free Freestuff Freebie Taxes Free Books Book Sale Dummies Book

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Avalara 2021 Sales Tax Changes Report

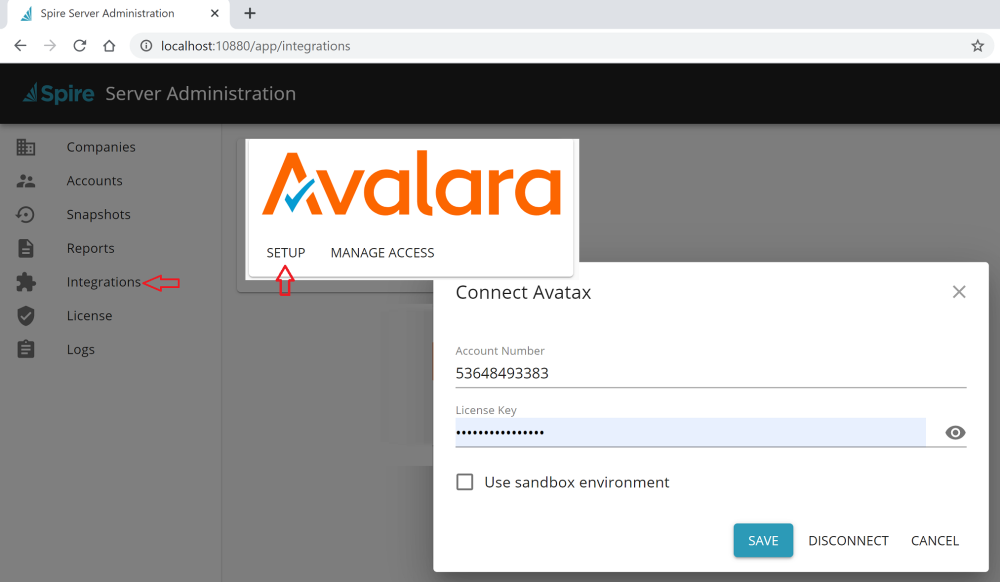

Avalara Sales Tax Spire User Manual 3 7

Beer Tax In America Infographic Beer Facts Beer Industry Beer

Avalara Vs Vertex Comparison Getapp

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Understand Sales Tax Holidays In Avatax Avalara Help Center

Avalara Avatax For Adobe Commerce Adobe Exchange

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Configuration Of Taxation With Avalara Mr96

3 Reasons Why Your Business Should Have Avalara S Avatax Excelym Netsuite Solution Provider

Shopify Plus Sales Tax Filing Automation Avalara

Set Up An Account Or A Product As Tax Exempt With Avatax Accounting Seed Knowledge Base